income tax calculator philippines

Accordingly the withholding tax. Income Tax Taxable Income 12 X Y 12 Where X is the minimum value of the particular salary range and Y is the respective percentage.

Tax Calculator Compute Your New Income Tax

There are now different online tax calculators in the Philippines.

. Since your taxable income is. Income tax for Philippines is the individual income tax consists of taxes on compensation income from employment business income and passive. You must always be sure to go with the best efficient updated and legitimate online tax calculator program.

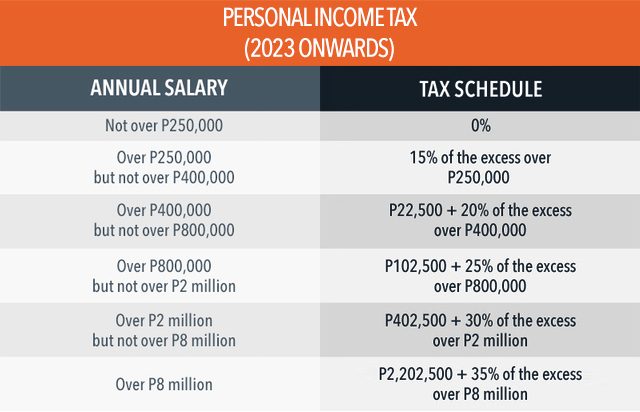

The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out your income tax and salary after tax based on a. Income Tax Calculator Philippines Who are required to file income tax returns Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident citizens. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. SSS Contribution Calculator PhilHealth Contribution. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes.

The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2023 and is a great calculator for working out your income tax and salary after tax based on a. Philippines Residents Income Tax Tables in 2023. The Monthly Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out your income tax and salary after tax based on a.

For self-employed individuals earning income solely from business andor profession. Aside from the main Tax Calculator Philippines we have also create other useful calculators for you. Philippine Public Finance and Related.

Income tax for Philippines is the individual income tax consists of taxes on compensation income from employment business income and passive income interests dividends. Income tax due 8 x Gross sales or receipts Non-operating income Php. Philippines Income Tax Calculator.

2022 Bir Train Withholding Tax Calculator Tax Tables

Provision For Income Tax Definition Formula Calculation Examples

How To Calculate Income Tax In Excel

Tax Calculator Compute Your New Income Tax

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube

How To Calculate Foreigner S Income Tax In China China Admissions

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Income Tax In Excel

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

How To Calculate Income Tax In Excel

How To Create An Income Tax Calculator In Excel Youtube

Tax Calculator Philippines 2022

2022 Bir Train Withholding Tax Calculator Tax Tables

How To Calculate Income Tax In Excel